The Top 20 Markets Where It’s Cheaper To Rent Than Own a Single-Family Starter Home

Getty Images (3)

If you’ve been sidelined in the single-family homeownership dream, you can console yourself with the knowledge that you’re saving over $1,000 a month.

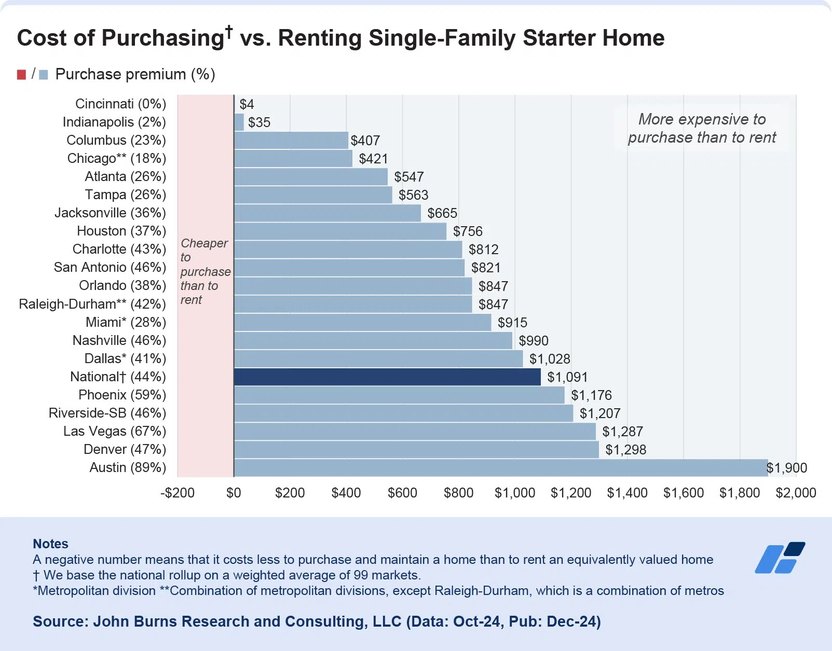

In the top 20 single-family rental markets, it remains cheaper to rent than to own, when comparing monthly rent to the monthly mortgage payment and maintenance costs for a comparable starter home.

On average, purchasing a starter single-family home now costs $1,091 more per month than renting a comparable property, according to a new report from John Burns Research & Consulting. With other types of properties included, the gap dips to $1,067, according to the Realtor.com® economic research team.

“No surprise here, it’s still more expensive monthly to buy a single-family home than it is to rent one,” says Danielle Nguyen, John Burns’ vice president of research.

While the gap between renting and buying has decreased slightly since last year, it remains far higher than the historical national average of $233. (The last time it was cheaper to own than to rent was in 2016. It almost got there in the early days of the COVID-19 pandemic, but not quite.)

The study defined starter homes as homes that sold for 80% or less of the area’s overall median sales price.

Although renters save on their monthly costs in all of these top 20 markets, it’s important to note that they miss out on building equity in their home, which can be an important way to increase wealth over time.

A recent study from the Aspen Institute found that homeowners in America had a median net worth of $400,000 as of 2022, while the typical renter’s net worth was just $10,400.

Why is it cheaper to rent than to own?

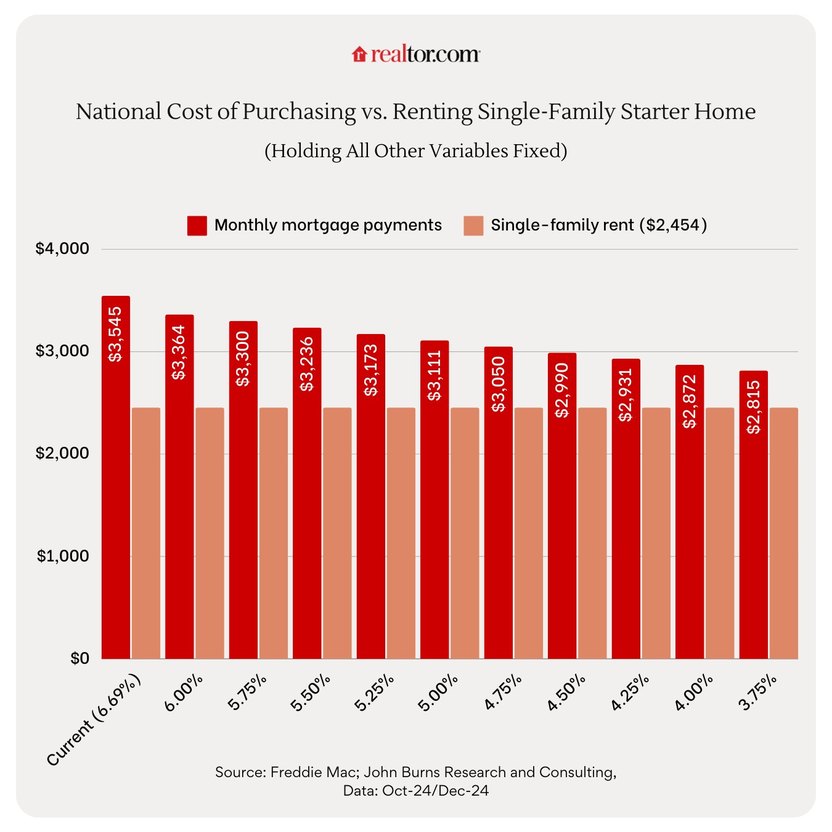

The culprit in this spread is not just historically high home prices and tight supply, but mortgage rates, which still hover at almost 7% for a fixed 30-year mortgage.

Rates would need to come down to 3.75% to lower the homeownership premium for a single-family house to the historical average of 14%, according to the report.

Given that mortgage rates aren’t predicted to dip that low again any time soon, what can one do to participate in the homeownership dream?

If possible, move to one of the markets where the spread is less than average, or even negligible. In Cincinnati, for instance, the premium to own is just $4 over renting.

You could also look into new construction.

“Many homebuilders are finding success by offering mortgage rate buy-downs, reducing rates to between 4% and 5% (or even lower),” says Nguyen. “This helps bridge the cost gap between buying and renting.”

One place first-time buyers might want to stay away from is Austin, TX, where it remains significantly pricier to own a starter home than to rent one.

Here are the top 20 single-family rental markets, ranked by the monthly savings for renters compared with homeowners.

1. Austin, TX

Purchase premium: 89%

How much you will save per month by renting: $1,900

Median rent: $2,000

Realtor.com

2. Denver, CO

Purchase premium: 47%

How much you will save per month by renting: $1,298

Median rent: $1,850

3. Las Vegas, NV

Purchase premium: 67%

How much you will save per month by renting: $1,287

Median rent: $2,000

4. Riverside-San Bernardino, CA

Purchase premium: 46%

How much you will save per month by renting: $1,207

Median rent: $2,050

5. Phoenix, AZ

Purchase premium: 59%

How much you will save per month by renting: $1,176

Median rent: $1,700

Realtor.com

6. Dallas, TX

Purchase premium: 41%

How much you will save per month by renting: $1,028

Median rent: $1,800

7. Nashville, TN

Purchase premium: 46%

How much you will save per month by renting: $990

Median rent: $2,400

8. Miami, FL

Purchase premium: 28%

How much you will save per month by renting: $915

Median rent: $3,000

9. Raleigh-Durham, NC

Purchase premium: 42%

How much you will save per month by renting: $847

Median rent: $1,600

10. Orlando, FL

Purchase premium: 38%

How much you will save per month by renting: $847

Median rent: $2,100

11. San Antonio, TX

Purchase premium: 46%

How much you will save per month by renting: $821

Median rent: $1,650

Realtor.com

12. Charlotte, NC

Purchase premium: 43%

How much you will save per month by renting: $812

Median rent: $1,750

13. Houston, TX

Purchase premium: 37%

How much you will save per month by renting: $756

Median rent: $1,650

14. Jacksonville, FL

Purchase premium: 36%

How much you will save per month by renting: $665

Median rent: $1,680

15. Tampa, FL

Purchase premium: 26%

How much you will save per month by renting: $563

Median rent: $2,170

16. Atlanta, GA

Purchase premium: 26%

How much you will save per month by renting: $547

Median rent: $1,880

17. Chicago, IL

Purchase premium: 18%

How much you will save per month by renting: $421

Median: $2,150

18. Columbus, OH

Purchase premium: 23%

How much you will save per month by renting: $407

Median rent: $1,650

19. Indianapolis, IN

Purchase premium: 2%

How much you will save per month by renting: $35

Median rent: $1,620

20. Cincinnati, OH

Purchase premium: 0%

How much you will save per month by renting: $4

Median rent: $1,380

Realtor.com

Categories

Recent Posts

GET MORE INFORMATION