Will Homeowners Finally Sell in 2025? Here’s What the Experts Say, Amid a Glimmer of Hope

Mario Tama/Getty Images

The U.S. housing market crawled to a standstill last year—and while the latest projections show that 2025 is expected to bring only limited relief to buyers and sellers, there is a glimmer of hope on the horizon.

The year closed out with the strongest seasonal slump since January 2023. Homes lingered on the market for a whopping 70 days, up from 62 in November. It made December 2024 the slowest festive season in five years.

Inventory also plummeted 8.6% from November, marking the most precipitous drop in nearly two years.

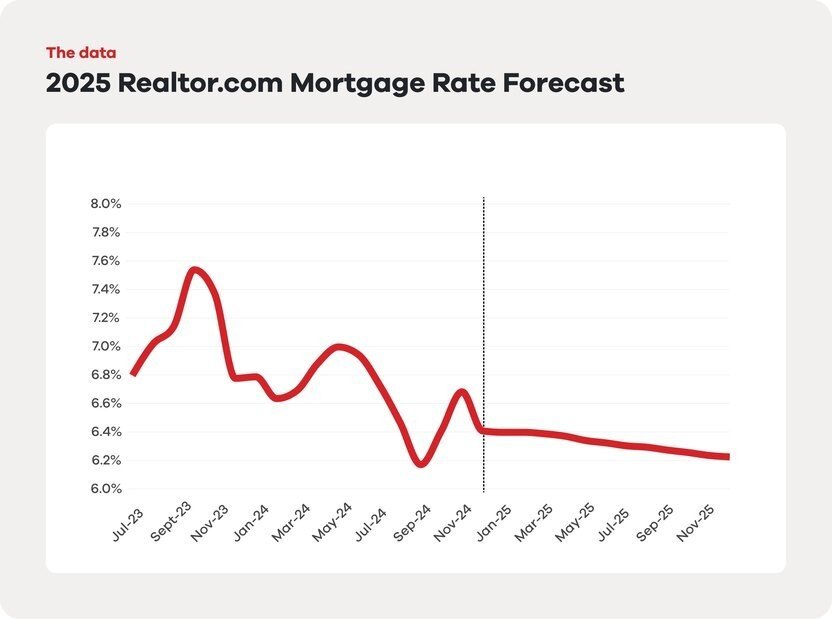

Meanwhile, mortgage rates reached a six-month high, hitting 6.91% for the average 30-year fixed home loan for the week ending Jan. 2, according to the latest numbers from Freddie Mac.

On top of that, in mid-December, the Federal Reserve announced a plan for fewer-than-anticipated rate cuts in 2025, which was expected to have a chilling effect on the already catatonic market.

The Realtor.com® economic research team projects that mortgage rates will average 6.3% through 2025 and end 2024 at around 6.2%, dashing any hopes for a return to the COVID-19 pandemic-era below-3% rate.

The ‘lock-in’ effect still grips homeowners

The projected above-6% mortgage rate for the duration of 2025 is bad news not only for prospective buyers, but also for would-be sellers, who have spent the past year in the grips of the “lock-in” effect, which has made them unwilling to list their properties and part with their current, significantly lower mortgage rates.

A report from the Consumer Financial Protection Bureau released back in September revealed that about 60% of the 50.8 million active mortgages had interest rates below 4%, way lower than the December rate of 6.91%.

Homeowners fortunate enough to be paying off their mortgage at the below-4% rate would think twice before moving to sell their home and then be forced to take out a new mortgage at a much higher rate.

“We expect the willingness of homeowners to sell their existing home and buy a new one to wane,” says Realtor.com Chief Economist Danielle Hale. “Put simply, potential home sellers and the market in general will still feel the effects of mortgage rate lock-in, which is more acute when rates are higher.”

But there are glimmers of hope on the horizon.

Hale says that while the first months of 2025 will see only a small increase in home stock, at least in part because of the lock-in effect’s persistent hold on homeowners, come spring, the inventory levels are projected to climb, even above the typical seasonal boost. She also projects that they will remain high throughout much of the summer.

“Time will continue to be an important healer of mortgage rate lock, with only modest help from lower rates expected in 2025,” Hale explains. “Even in today’s tough housing market, life happens and some households move, buying and selling in whatever conditions the market offers.”

Home prices are set to rise

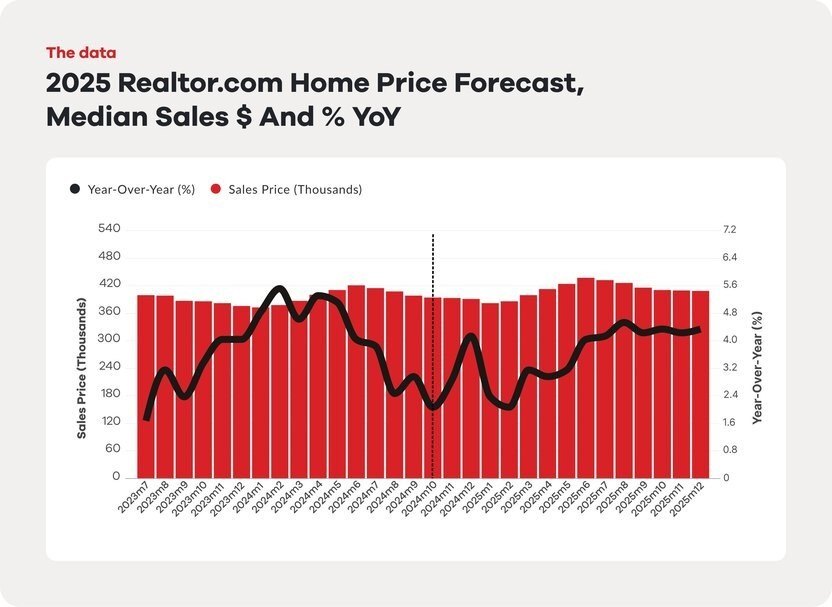

Last year saw home prices surge at a 4% rate, up from 1.1% in 2023, despite the stubbornly high mortgage rate and a glut of inventory driven by unmotivated buyers and sellers.

The median home price in December inched down by 1.8% year over year, arriving at $402,502, after peaking at $406,100 in November. But there is more to those numbers than meets the eye.

When the size of the listed properties is taken into account, the average home has increased in asking price per square foot by 1.3% compared with the same time in 2023. That signals that the stock of smaller and cheaper homes continues to grow in share.

Realtor.com economists expect to see more of the same in the coming months, with home prices projected to go up throughout 2025 at a rate of 3.7%, spurred on by a combination of marginally lower mortgage rates and an 11.7% jump in existing for-sale inventory compared with last year.

“We think the downward pressure on price growth due to this supply-side effect will slightly win out over the upward pressure on price growth due to falling mortgage rates next year (at least compared to the relative balance this year),” says Hale.

But another factor to keep in mind is that there are still not enough homes being constructed in the U.S. to keep up with the growing demand for housing due to more than a decade of under-building, which is bound to drive the price of existing properties up.

According to a Realtor.com analysis released last February, the market in 2023 was missing up to 7.2 million homes.

Older, richer homebuyers are still in charge

The National Association of Realtors® 2024 Homebuyers and Sellers Report revealed that buyers over the past year tended to be older and wealthier than in the past. The median age of homebuyers was 56, up 7 years compared with 2023. The median age of first-time, repeat, and all buyers each reached record highs.

This should come as no surprise, considering that the median listing price topped $402,000 in December, up an eye-watering 68% compared with November 2019, when the median home price hovered around $274,000, according to the NAR report.

Meanwhile, just 24% of homebuyers last year were first-time buyers, a record low in the data’s 44-year history, says Realtor.com senior economic research analyst Hannah Jones.

This trend favoring older and more deep-pocketed house hunters is expected to carry into the new year.

“It is likely that repeat buyers and older buyers will continue to participate in the housing market as a larger share than younger and first-time buyers in 2025,” adds Jones. “Still-expensive housing will make it challenging for younger buyers, especially those without the benefit of existing home equity, to break into the market.”

Housing marketing anticipates a ‘Trump bump’

With President-elect Donald Trump‘s inauguration for a second term just around the corner, Realtor.com economists anticipate potentially major shifts to the housing market, running the gamut from an easing of regulations to tax policy changes and even a wholesale recalibration of the supply-and-demand dynamics.

Trump’s first term in the White House was marked by tax cuts, deregulation, and adoption of pro-business policies aimed at boosting economic growth.

“Many of these initiatives could return in a Trump-led 2025, potentially affecting everything from mortgage rates to new construction projects and homeownership affordability,” says Hale.

But the anticipated “Trump bump” effect could be tempered by economic factors that are out of a president’s control, such as interest rates, inflation, and changing demographic trends.

What’s more, it remains to be seen whether Trump’s raft of campaign proposals to mitigate the crippling housing shortage—by making federal land available for homebuilding to boost supply, ease regulations, and tackle inflation—would go from mere stump-speech promises to actionable policies, and how quickly.

Mortgage rates just north of 6% are expected to keep payments essentially static in 2025 despite growing listing prices. But an anticipated higher economic growth under Trump could lead to a bump in incomes. And if effective household tax rates go down, people could see a net increase in their disposable household income.

“If both income growth and lower tax rates come to fruition, we could see homes become somewhat more affordable in 2025 than in the past few years,” Hale notes.

Other key items on Trump’s political agenda, however, have been called into question by economists and housing experts, including his oft-repeated vows to raise tariffs on major trading partners such as China, Canada, and Mexico, and to rein in immigration.

“Both tariffs and stricter immigration policies are likely to be acutely felt by the construction industry, and would push costs higher,” warns Hale.

The Sun Belt continues to heat up

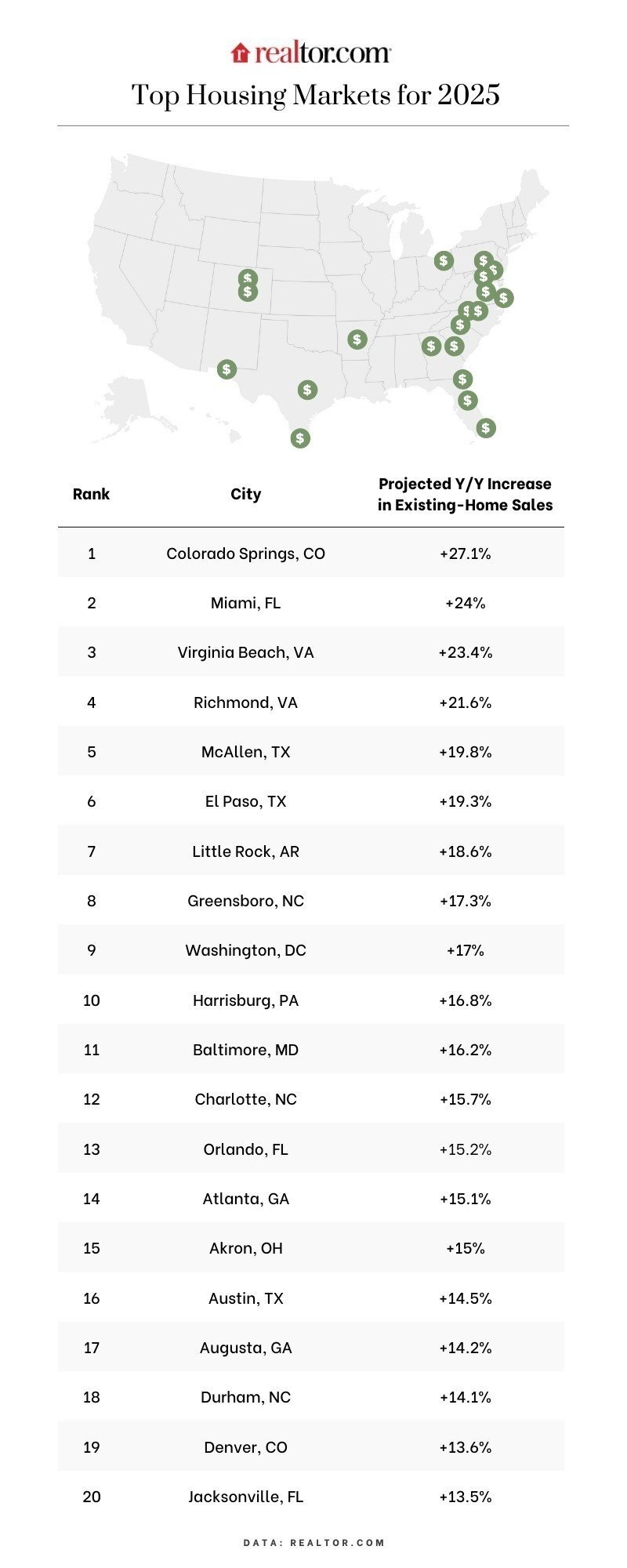

While economists anticipate a modest improvement in the housing inventory on the national level amid gradually decreasing mortgage rates and an easing of the lock-in effect, two U.S. regions continue to outperform the rest of the country.

The top 10 markets for 2025 are exclusively in the South and West, with Texas, Florida, and Virginia topping the list for projected home prices and home sales. Other states boasting a healthy home inventory include Colorado, Arizona, Georgia, and North Carolina.

A closer look at the data shows that of all the largest metro areas, Colorado Springs, CO, is leading in existing-home sales count, with a 27.1% increase year over year, followed by Miami (+24%) and Virginia Beach, VA (+23.4%).

“The markets we’re forecasting to lead the country in home sales in 2025 are markets that have better recovered to their pre-COVID-19 levels of home sales, and we expect them to hold that momentum in the year ahead,” according to the Reator.com Top Housing Markets for 2025 report.

The market is in a holding pattern, but there is good news

Overall, Realtor.com economists expect 2025 to bring slightly lower mortgage rates coupled with moderate price growth, which means that would-be buyers are not likely to see any dramatic changes in housing costs.

“Still-high home prices may keep many buyers on the sidelines, waiting for more affordable housing options,” says Jones.

The good news is that lower mortgage rates will finally begin eroding the sticky lock-in effect, which should boost inventory and result in more sales.

“Continued improvement in inventory levels mean that buyers may have more options than in the last few years,” Jones adds.

And there’s a further cause for optimism in the form of an anticipated increase in new construction activity, which should start filling some of the supply gap caused by years of under-building.

Categories

Recent Posts