Google Maps Shows True Devastation of California Wildfires as Total Cost of the Damage Is Revealed

Google Maps; Mario Tama/Getty Images

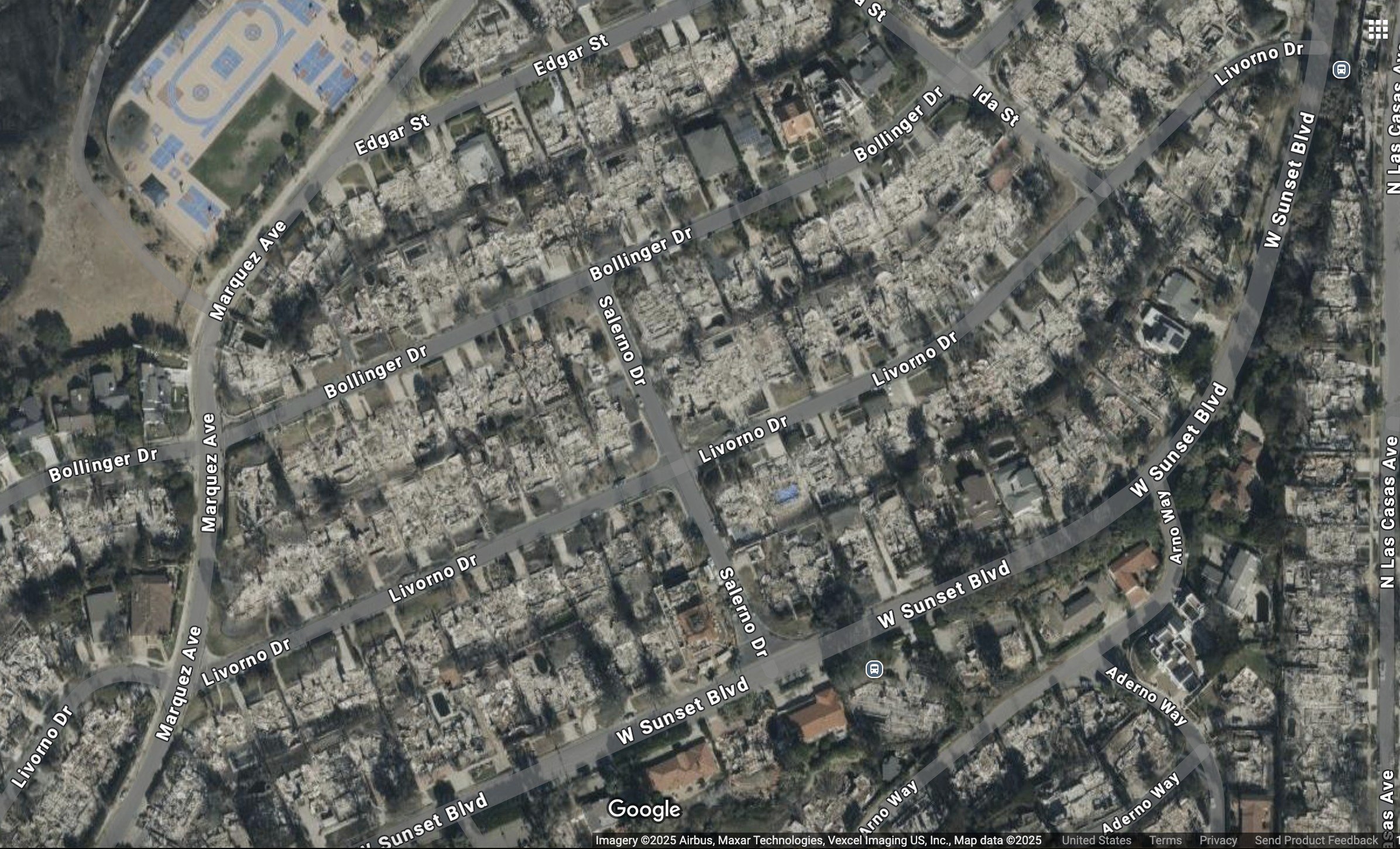

Google Maps’ satellite images have revealed the catastrophic scale of the Los Angeles wildfires as UCLA economists reveal that the two largest blazes may have caused up to $164 billion in property and financial loss.

Igniting in early January, the Palisades and Eaton fires, driven by powerful Santa Ana winds, scorched through a combined total of more than 37,000 acres. By the time the blazes were finally contained more than three weeks later, they killed at least 29 people and ravaged over 16,240 homes and businesses.

Updated Google Maps images of the upscale, star-studded neighborhood of Pacific Palisades and the working-class suburb of Altadena show entire city blocks of homes and businesses reduced to piles of ash and debris.

In the satellite images, what were once neat rows of homes surrounded by palm trees and lush greenery now appear as little more than orderly plots of soot-covered rubble.

On some of the properties, the remnants of in-ground pools of varying shapes and sizes—now drained of water and blackened by flames—could still be seen amid the grey desolation.

But what the pictures also reveal is the apparent randomness of the inferno’s path. For example, the blaze spared five houses all near the corner of Bollinger Drive and Ida Street, even as the rest of that block and the overwhelming majority of neighboring blocks were razed.

(Google )

(Google)

In Altadena, the Eaton Fire cut an equally devastating path of destruction through the previously vibrant and diverse community, leaving only a few homes still standing in the post-apocalyptic landscape.

Along Highland Avenue in Altadena, multiple seemingly intact homes are seen still standing beside debris field after debris field of what used to be neighbors’ houses, which were incinerated by the wind-whipped flames.

Economists estimate cost of L.A. fires

Over the past weeks, economic forecasters and insurance experts have been trying to tally the financial damage caused by the unprecedented natural disaster in L.A. County. And while the estimates differ widely, everyone agrees that the total sum will be staggering.

A new bombshell report from the UCLA Anderson Forecast put the estimated property and capital damage from the Palisades and Eaton fires alone at between $95 and $164 billion, with insured losses potentially reaching a jaw-dropping $75 billion.

The UCLA report’s authors acknowledged that the estimates laid out in their report are based on various assumptions and may be subject to future revision.

The new insured losses estimate is dramatically higher than a recent analysis from CoreLogic, which projected the losses to fall within a range of $35 billion and $45 billion.

Even those lower projections would make the January fires by far the largest wildfire insurance industry loss event in U.S. history, surpassing the $11.5 billion in insured losses in the 2018 Camp Fire in Northern California.

(Google)

UCLA economists Zhiyun Li and William Yu, who co-authored the report, emphasizes that their insured losses figure “does not represent the full cost to property owners.”

According to the report, insurance policies may not cover all expenses related to the fire, and homeowners without mortgages may not have insurance coverage at all.

The authors also point out that many insurance providers have dropped thousands of policies in the impacted areas, forcing homeowners to turn to California’s insurer of last resort, FAIR Plan, which limits coverage to $3 million of residential policyholders and $20 million for commercial policies.

“The final insured claims could be lower than our estimates because many homeowners are either uninsured or have limited coverage under the FAIR Plan,” the UCLA experts write.

(Google)

According to the California Department of Insurance’s online wildfire claims tracker, last updated on Jan. 30, $4.2 billion in claims has been paid to date—mostly to cover home, business, and living expenses.

California’s insurance crisis

The wildfires could not have come at a worse time for California, which already has been in the throes of an insurance crisis as multiple national carriers have stopped writing new policies in fire-prone areas.

State Farm had by far the largest share of the California residential market at around 20% in the years leading up to the fires.

But just a few months before disaster struck, the insurer wisened to the high levels of risk it has been taking on by offering coverage in areas vulnerable to fire and announced that it would drop some 30,000 homeowners, reported The Wall Street Journal.

About a third of the impacted places were in the communities that burned down in January.

State Farm’s hasty retreat left thousands of homeowners in the lurch, forced to turn to the state’s FAIR Plan offering the most basic coverage at a high cost.

State Farm hasn’t revealed its projected total losses related to the January fires. So far, the company reported having paid out around $1 billion on 8,700 claims.

On Monday, the insurer asked California regulators to sign off on a 22% emergency rate hike to avert a “dire situation.”

“Insurance will cost more for customers in California going forward because the risk is greater in California,” State Farm said in a press release. “Higher risks should pay more for insurance than lower risks.”

The new demand comes after State Farm asked regulations in June 2024 to approve a 30% premium hike for homeowners, sparking allegations that it was trying to increase its parent company’s profits by presenting itself as being in the red.

State Farm has vehemently denied these accusations.

In the days after the outbreak of the first fires, California’s insurance authority imposed a yearlong ban on policy cancellations in areas hardest hit by the disaster.

The moratorium came just weeks after the state insurance commission announced a new rule requiring private insurance companies to start writing new policies in high-risk areas if they wanted to continue doing business in California.

(Google)

(Google)

But the commission offered some concessions, allowing insurers to pass the costs associated with coverage of extreme risk on to their customers.

The UCLA Anderson Forecast predicted that in the months and years to come, homeowners will likely face major insurance rate hikes as a result of the new regulations.

L.A.’s housing market headed for dire straits

The UCLA report predicted that the colossal loss of homes in and around L.A. could sharply boost demand for rental units, as displaced residents seek temporary accommodation.

Over the past decade, L.A. County has issued permits for between 20,000 and 25,000 new housing units annually. But the January wildfires have wiped out two-thirds to three-quarters of the annual housing inventory.

According to California Department of Housing and Community Development Regional Housing Needs Allocation, to meets its housing affordability goals, L.A. County must build 812,000 units by 2029; but so far only 71,000 units have been permitted, which amounts of under 9% of the target.

In response to the insufficient housing supply in California, Gov. Gavin Newsom, a Democrat, issued an executive order on Jan. 12 to expedite the building of homes and businesses destroyed by the fires. Los Angeles Mayor Karen Bass followed suit, issuing a similar order to speed up rebuilding efforts.

“Despite these measures, the housing affordability issue is expected to worsen in the short term,” UCLA economists predict. “If L.A. fails to meet its RHNA obligations, housing affordability challenges are likely to persist in the long term.”

Real estate community coming to victims’ aid

In the wake of the fires, the California Association of Realtors on Friday published an open letter, expressing support for homeowners who suffered losses and warning them of pitfalls to watch out for in the coming weeks.

“The devastation caused by the recent wildfires in Southern California is beyond words. Our hearts are heavy for those whose lives have been upended, so many of whom are now facing unimaginable losses,” C.A.R. President Heather Ozur said in the letter. “Despite this tragedy, we continue to be inspired by the extraordinary courage shown by our first responders. To those who risk everything to protect life and preserve property, we are deeply grateful.”

(Google)

(Google)

Ozur continued that her organization is not only committed to helping rebuild the hard-hit communities—but also to protect the victims from those who “may seek to exploit” their newly vulnerable state.

“We want you to know your rights, to stay vigilant against predatory practices, and to report any misconduct you become aware of,” Ozur stressed.

The letter highlights three key areas that consumers must be aware of, including price gouging by landlords, a variety of scams, and unsolicited undervalued offers to buy property in areas impacted by the fires.

Categories

Recent Posts